How AI Auto-Categorizes Your Expenses (And Why It Matters)

Stop manually sorting transactions. Nexafin's AI categorizes expenses instantly with 90% accuracy. Connect 12,000+ banks, see spending patterns automatically.

Are you tired of spending hours sorting through bank statements and receipts? You're not alone. The average American makes nearly 50 financial transactions per month, according to the Federal Reserve's 2024 Diary of Consumer Payment Choice. Keeping up manually isn't realistic, and most people who try give up within weeks.

That's where automated expense categorization comes in.

What is Automated Expense Categorization?

Automated expense categorization uses artificial intelligence to instantly sort your financial transactions into specific categories. Think of it as a financial assistant that works around the clock, organizing every purchase, bill payment, and deposit into meaningful categories, without you lifting a finger.

How Nexafin's Categorization Works

When a transaction occurs, Nexafin's system immediately analyzes its details and context. It considers the merchant name, transaction amount, timing, and historical patterns to accurately categorize each expense.

This happens instantly, giving you real-time insights into your spending without any manual input needed.

Our categorization achieves approximately 90% accuracy out of the box. As you use the system, it learns your preferences and adapts to your unique financial habits, so that remaining 10% shrinks over time.

Connect All Your Accounts in One Place

Managing multiple accounts shouldn't mean juggling multiple apps. Nexafin connects with over 12,000 financial institutions worldwide, from major banks to local credit unions, including European banks via GoCardless.

Whether you're managing personal accounts, business expenses, or both, secure integration brings all your financial data into one organized dashboard.

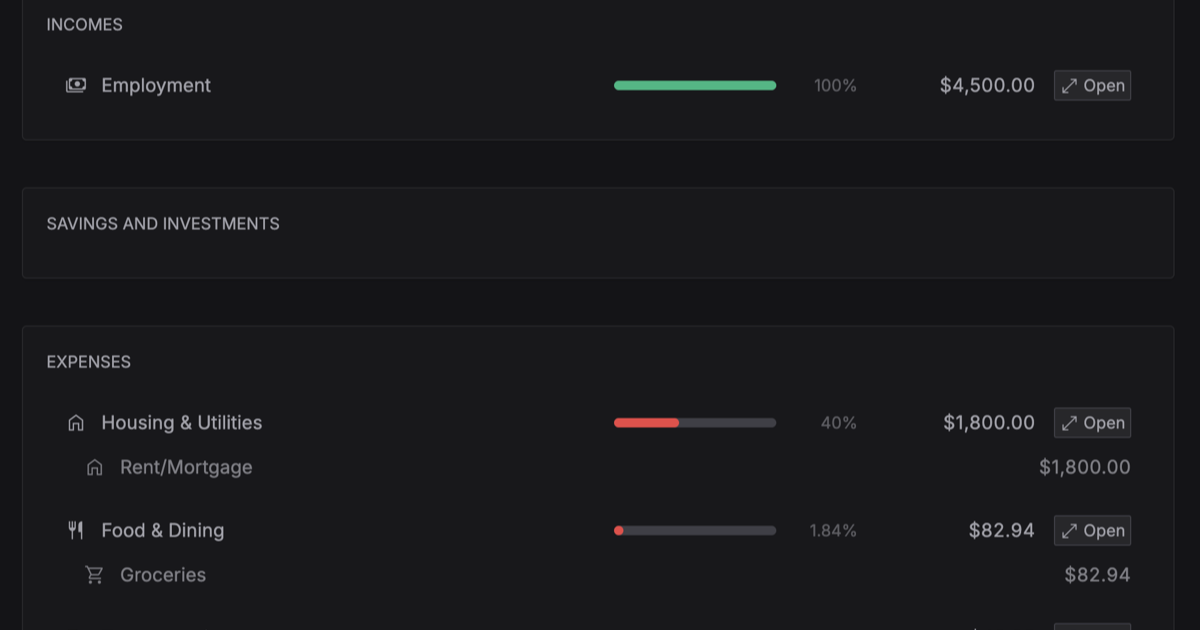

What You Can See at a Glance

With transactions automatically categorized, you get immediate visibility into:

- Spending by category: See exactly how much goes to groceries, dining, subscriptions, transportation

- Recurring charges: Spot subscriptions you forgot about or bills creeping up

- Spending trends: Notice patterns like seasonal increases or gradual lifestyle inflation

- Income vs. expenses: Understand your real cash flow without spreadsheet math

The system surfaces patterns you might miss on your own, like that streaming service you haven't used in months, or the slow creep in your food delivery spending.

Security Without Compromise

Your financial security isn't an afterthought. Nexafin uses 256-bit AES encryption, the same standard used by major financial institutions, to protect your data both in transit and at rest.

More importantly, Nexafin uses read-only access. We can see your transactions to categorize them, but we can never move your money. Your accounts stay secure while you gain visibility into your spending patterns.

Why Automation Matters

Manual expense tracking fails for a simple reason: it requires consistent effort over time. Miss a few days, and you're playing catch-up. Miss a few weeks, and most people abandon the effort entirely.

Automated categorization removes that friction. Your transactions are organized whether you check the app daily or weekly. The insights are there when you need them, without the homework.

Multiple Ways to Get Your Data In

Auto-categorization works regardless of how your transactions arrive in Nexafin:

- Bank connections: Link your accounts for automatic syncing

- PDF statements: Upload bank and credit card PDFs directly

- CSV files: Export from your bank and import manually

Choose the method that fits your comfort level. The categorization works the same either way.

See Where Your Money Actually Goes

Nexafin gives you visibility into your finances without the manual work. Connect your accounts, or import your statements, let auto-categorization do its job, and finally understand your spending patterns.

Ready to take control of your finances?

Track spending, monitor net worth, and gain clarity on your money.

Start Free Trial →